Protecting the ones you love is important, but that protection should not only come into effect after you are gone.

With a life insurance policy in force, your spouse and children could claim a large sum of money from your insurance company if you die. This payout could create an easier financial life for your survivors. Your family could use this benefit to pay off bills, pay off the mortgage, pay for the kids’ college, or any other need. Other shoppers buy coverage to use as collateral on a business loan or to cover their burial expenses.

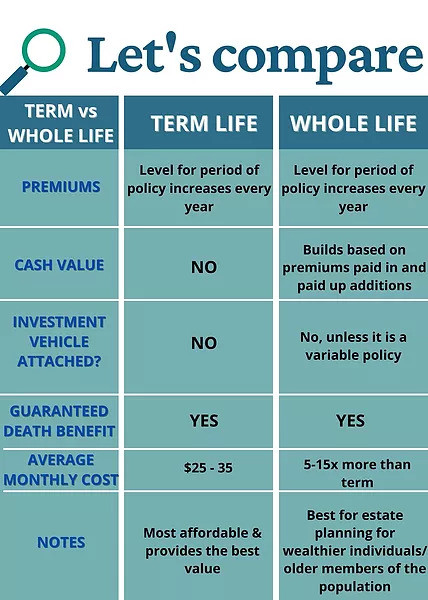

Life insurance rates vary from person to person. The cost of an individual policy depends on the type of life insurance you buy (term or whole), your health, and the policy itself, like how long it lasts and additional features added.

You can compare life insurance quotes online for free to get an estimate of how much you will pay for your policy.

Most people choose between two types of life insurance: Term life insurance, which expires after a set period of time (the term length), and whole life insurance, which does not expire and can include a tax-deferred cash value. It is often more expensive than term life insurance policies.

Whole life insurance can be good for complex financial situations, such as paying estate taxes. Term life insurance is the right choice for most shoppers because it is cheaper and more straightforward.

And there are even more types of life insurance, each with benefits, drawbacks, and unique properties. Talk to an expert before choosing a more complex policy – a term life policy will work best in most cases.

What type of life insurance should you get?

Guaranteed Life Insurance

If you are looking for a death benefit that pays out one day and the cash value is not your interest, then this is the policy for you. As far as Seniors, it is a great alternative versus whole life or final expense policies.

Final Expense Insurance

If you are looking for life insurance coverage that you can specifically use to cover the actual cost of your death and funeral arrangements, final expense insurance, which can also be referred to as burial insurance or funeral insurance, may be right for you. Policies are offered at smaller coverage amounts, usually between $10,000 to $50,000.